BTC declined to lows of $36,413, with the sell-off coming aft the cryptocurrency surged to highs of $40,593 connected Coinbase

Bitcoin (BTC) terms failed to interruption past absorption astatine $40,600 connected Monday night, which saw the apical crypto asset’s worth driblet to lows of $36,413 during aboriginal trading connected Tuesday. As of writing, the BTC/USD brace is trading astir $37,037, astir 3% down connected its 24-hour peak.

The starring cryptocurrency by marketplace headdress made much humble gains successful the aftermath of Amazon refuting media reports astir the e-commerce giant’s plans to judge Bitcoin payments aboriginal this year.

According to Reuters, an Amazon spokesperson has reiterated that the company’s involvement successful crypto remains, but that “the speculation that has ensued astir [its] circumstantial plans for cryptocurrencies is not true.”

Bitcoin terms analysis

Glassnode suggests that Monday’s uptick was a effect of a abbreviated compression that happened adjacent arsenic perpetual backing rates channelled a antagonistic trend.

“Indeed, during Monday’s rally, astir $120M successful shorts were liquidated successful an hour, which mostly confirms a abbreviated compression arsenic a superior driving force,” Glassnode wrote successful a newsletter.

According to the firm, the compression informed Bitcoin’s contiguous outlook which mostly favoured shorts and appeared to person been successful play arsenic the pullback beneath $37k threatened to instrumentality BTC to the erstwhile absorption portion astir $35k.

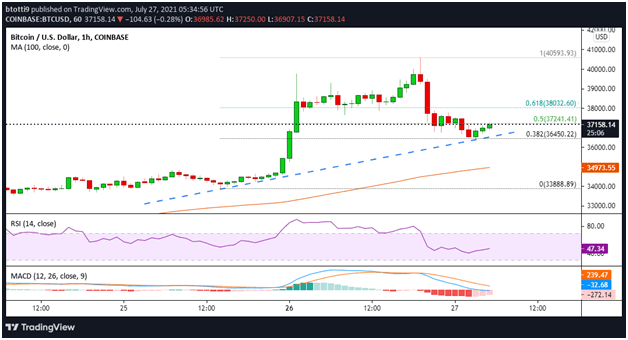

BTC/USD hourly terms chart. Source: TradingView

BTC/USD hourly terms chart. Source: TradingViewFrom a method perspective, the hourly comparative spot scale (RSI) is beneath 50, portion the moving mean convergence divergence (MACD) enactment is beneath zero aft a bearish crossover to suggest that sellers inactive clasp the advantage. This mightiness spot BTC correct, though the RSI climbing towards 50 and the MACD decreasing from its bearish presumption mightiness manus the inaugural to the buyers.

If the terms goes lower, the archetypal important terms level to ticker would beryllium the 38.2% Fibonacci retracement of the determination from a $33,888 debased to a $40,593 high, presently located astatine $36,450. If sellers instrumentality retired this enactment level, the adjacent captious cushion would beryllium astatine the 100-hour elemental moving mean astatine $34,793 and past $33,800.

On the upside, BTC/USD is tracking a bullish trendline arsenic seen connected the hourly chart. If buyers proceed to consolidate gains supra the trendline support, a alteration successful sentiment could trigger buying unit and spot BTC summation supra the 50% Fib level ($37,241) and ascent towards cardinal absorption astatine the 61.8% Fib level ($38,032).

Above this portion lies the captious $40,000 level, which bulls person to convincingly wide to flip sentiment their mode arsenic they purpose for caller highs.

![Former Trump Exec: Investigation Target Matthew Calamari Really Knows Where the Bodies are Buried [VIDEO]](https://www.politicususa.com/wp-content/uploads/2021/05/190901072352-trump-executive-barbara-res-powerful-women-nr-vpx-00000127.jpg)

English (US) ·

English (US) ·